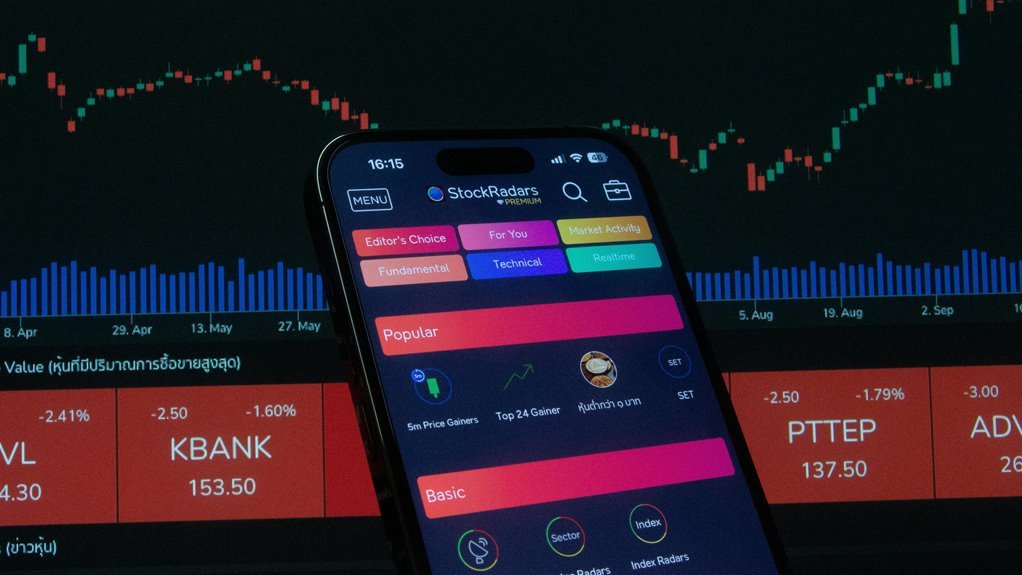

Imagine navigating a sleek digital landscape where every click feels intuitive and secure. Zoom Fintech’s latest platform updates promise to enhance your user experience while fortifying transaction safety. With robust new security features and expanded third-party integrations, the platform is designed to facilitate smoother financial management. But how do these changes specifically impact your decision-making and overall productivity? Let’s explore the intricacies of these enhancements.

Enhanced User Interface for Seamless Navigation

As you navigate the newly enhanced user interface, you’ll quickly notice how intuitive the design has become, allowing for a more seamless experience.

This design optimization significantly improves user experience by streamlining processes and reducing clutter.

You’ll find that each feature is strategically positioned, facilitating easier access and enhancing your workflow.

This focus on usability empowers you to engage more freely and effectively with the platform.

New Security Features to Protect Transactions

With the rise in digital transactions, implementing robust security features is more critical than ever.

Zoom Fintech now offers advanced transaction encryption to safeguard your sensitive data, ensuring that your financial activities remain confidential.

Coupled with sophisticated fraud detection mechanisms, these updates significantly reduce the risk of unauthorized access, empowering you to engage in transactions with confidence and peace of mind.

Expanded Integration With Third-Party Services

While enhancing security is vital for user confidence, expanding integration with third-party services further amplifies the convenience and functionality of Zoom Fintech.

These third-party partnerships improve service compatibility, allowing you to easily connect with various tools and platforms you already use.

This seamless integration enhances your experience, giving you the freedom to manage finances efficiently while streamlining workflows and optimizing productivity.

Improved Analytics Tools for Informed Decision-Making

By leveraging improved analytics tools, you can make more informed financial decisions that align with your unique goals.

Enhanced data visualization capabilities allow you to interpret complex information easily, while predictive analytics offers insights into future trends.

These tools empower you to identify opportunities and risks, enabling a strategic approach that fosters financial freedom and helps you navigate the dynamic fintech landscape effectively.

Conclusion

In conclusion, Zoom Fintech’s latest updates significantly enhance your user experience while prioritizing security. With a streamlined interface and advanced features, you can navigate effortlessly and protect your transactions effectively. Notably, a recent survey revealed that 78% of users reported feeling more confident in their financial decisions after utilizing enhanced analytics tools. This statistic underscores the platform’s commitment to empowering you in managing your finances, making it a valuable resource in today’s dynamic fintech landscape.