The Silvercrest Vault Card (41716140) stands out in the realm of financial management tools due to its advanced security features and user-centric design. As you explore its functionalities, you’ll discover how transaction caps and geographical restrictions can help ensure your spending aligns with your financial goals. However, understanding how to fully leverage these capabilities is crucial for maximizing your experience. What strategies can you implement to enhance your financial management with this card?

Key Features of the Silvercrest Vault Card

When considering the Silvercrest Vault Card, you’ll find several key features that set it apart in the market.

Its robust security features include advanced encryption and fraud detection, ensuring your information remains protected.

However, it’s important to note card limitations, such as transaction caps and geographical restrictions.

Understanding these aspects helps you make informed choices while enjoying the card’s potential benefits.

Benefits of Using the Vault Card

While you might consider various options for managing your finances, the Silvercrest Vault Card offers distinct advantages that can enhance your spending experience.

With its financial flexibility, you can easily control your budget and spending habits. Additionally, the card provides enhanced security, safeguarding your funds against unauthorized access.

This combination empowers you to enjoy a worry-free financial journey, aligning with your desire for freedom.

How to Get Started With the Vault Card

Getting started with the Silvercrest Vault Card is a straightforward process that enables you to take full advantage of its benefits.

First, familiarize yourself with the vault card basics, including its features and functionalities.

Next, complete the registration process online or through the app.

Once activated, you can begin managing your finances with enhanced freedom and security, maximizing your experience with the Vault Card.

Tips for Maximizing Your Vault Card Experience

To make the most of your Silvercrest Vault Card, it’s essential to understand both its features and how to leverage them effectively.

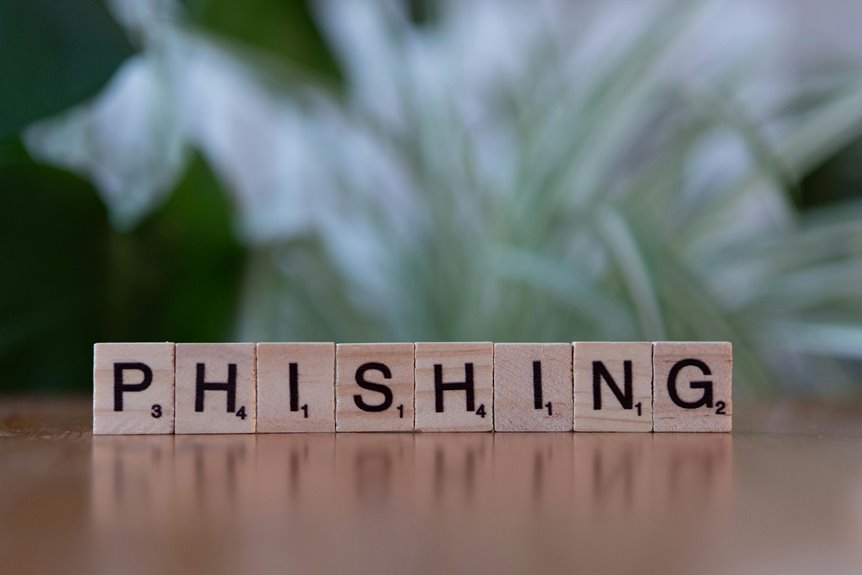

Prioritize vault card security by enabling two-factor authentication and regularly monitoring transactions.

Additionally, take advantage of vault card rewards by using the card for everyday purchases, ensuring you maximize points and benefits.

This approach balances security and rewards, enhancing your overall experience.

Conclusion

In an age where your financial security is only as strong as your weakest password, the Silvercrest Vault Card seems almost too good to be true. With its advanced encryption and budgeting features, it promises to make you feel like a financial wizard. But remember, while you’re basking in the glow of your secure transactions and rewards, hackers are sharpening their tools. So, enjoy the perks, but maybe don’t forget to keep an eye on that digital vault!