In today’s fast-paced financial landscape, understanding money management is crucial. You need reliable insights to navigate the complexities of personal finance effectively. That’s where Fintechzoom comes in. With expert analyses and practical advice, you can explore innovative budgeting tools and investment strategies designed for modern investors. But how do these resources translate into real-world financial empowerment? Let’s uncover the answers together.

The Importance of Financial Literacy in Today’s Economy

In today’s fast-paced economy, financial literacy isn’t just a nice-to-have; it’s essential for navigating the complexities of personal finance.

By investing in financial education, you empower yourself to make informed decisions.

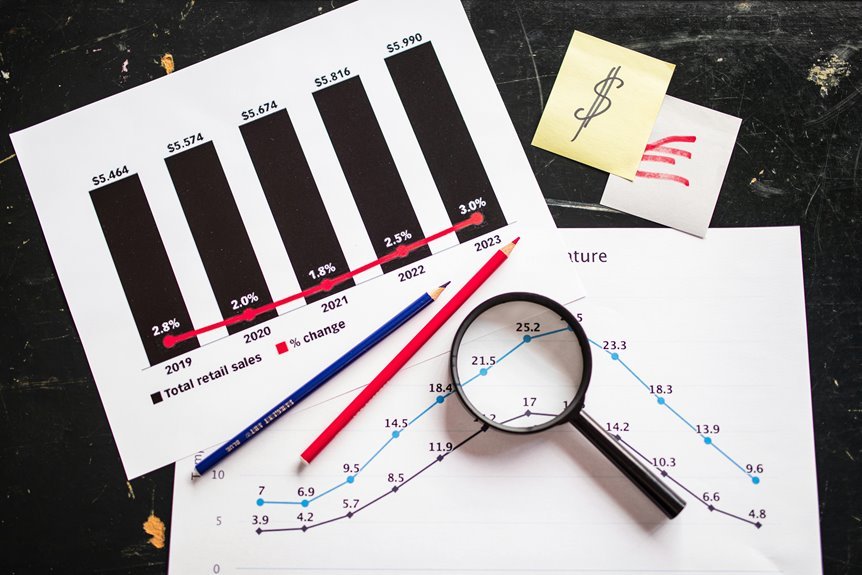

Mastering budgeting basics enables you to track spending, while effective investment strategies can help grow your wealth.

This knowledge fosters economic empowerment, giving you the freedom to achieve your financial goals.

Innovative Budgeting Tools for Modern Investors

Modern investors have access to a variety of innovative budgeting tools that can transform how they manage their finances.

Budgeting apps offer intuitive interfaces, helping you track expenses and align spending with your financial goals.

These tools enable you to take control of your money, freeing you from financial stress and empowering you to make more informed investment decisions.

Embrace technology to enhance your financial journey.

Understanding Cryptocurrency Trends and Opportunities

As the landscape of finance evolves, understanding cryptocurrency trends and opportunities becomes essential for savvy investors.

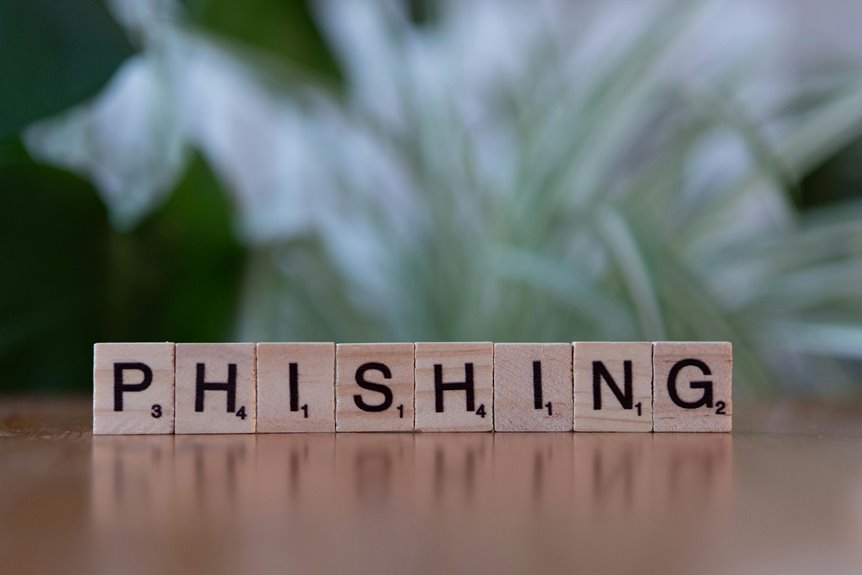

With ongoing cryptocurrency regulations shaping the market, staying informed allows you to navigate the inherent market volatility.

Identifying promising projects and adapting to changing landscapes can unleash your potential for profit while fostering a sense of freedom in your financial journey.

Embrace the challenge and explore these emerging opportunities.

Expert Tips for Building a Diversified Investment Portfolio

While many investors rush to chase the latest trends, building a diversified investment portfolio is a strategic approach that can mitigate risks and enhance potential returns.

Focus on various asset classes, such as stocks, bonds, and real estate, to balance your investment strategies.

Regularly conduct risk assessments to ensure your portfolio aligns with your financial goals and adapts to market changes.

Conclusion

In navigating the intricate landscape of personal finance, embracing the insights offered by Money Fintechzoom is your golden ticket to empowerment. By enhancing your financial literacy and leveraging innovative tools, you’re not just making ends meet; you’re crafting a robust financial future. As you explore cryptocurrency trends and build a diversified portfolio, remember that each informed decision is a step toward financial stability. So go ahead, seize these opportunities, and watch your financial aspirations flourish.