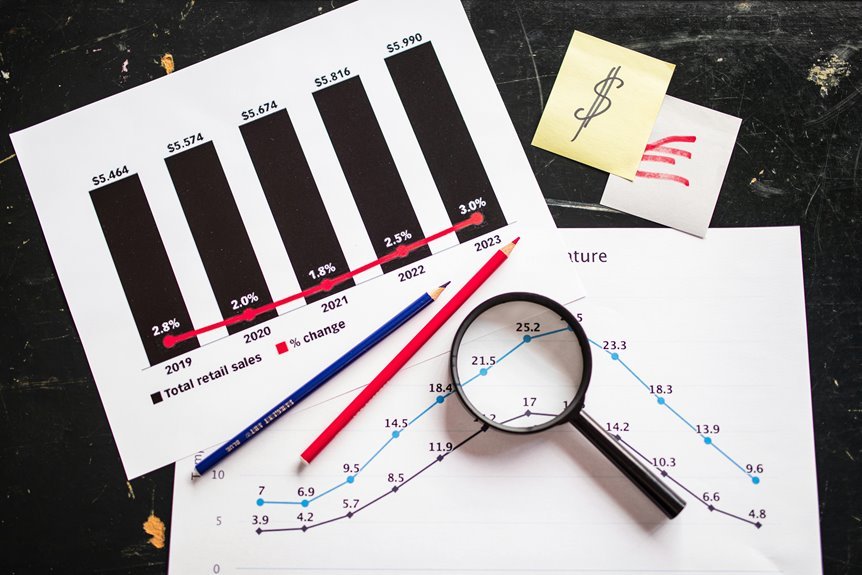

Did you know that nearly 70% of homebuyers underestimate their monthly mortgage payments? Understanding the features of the Fintechzoom Mortgage Calculator can significantly change that. This tool not only simplifies the estimation process but also empowers you to evaluate various loan options effectively. By exploring its functionalities, you can enhance your budgeting skills and make more informed decisions about your home financing. What other insights might this calculator offer to streamline your mortgage journey?

Key Features of the Fintechzoom Mortgage Calculator

The Fintechzoom Mortgage Calculator boasts several key features that make it an invaluable tool for homebuyers and homeowners alike.

Its user-friendly interface simplifies navigation, ensuring you can access vital information effortlessly.

Plus, with customizable options, you can tailor calculations to suit your specific financial situation.

This level of personalization empowers you to make informed decisions, enhancing your homebuying experience and financial freedom.

How to Estimate Your Monthly Payments

Estimating your monthly mortgage payments can feel daunting, but with the Fintechzoom Mortgage Calculator, it becomes a straightforward task.

Simply input your loan amount, chosen interest rates, and loan term. The calculator will quickly compute your monthly payment, giving you a clear picture of your financial commitment.

Understanding these figures empowers you to make informed decisions about your future home financing options.

Evaluating Different Loan Options

When you’re considering different loan options, it’s crucial to weigh the benefits and drawbacks of each to find the best fit for your financial situation.

Explore various loan types, like fixed-rate and adjustable-rate mortgages, and compare their interest rates.

Understanding these elements will empower you to make an informed decision, ensuring your mortgage aligns with your financial goals and desired freedom.

Budgeting for Your Mortgage Journey

As you embark on your mortgage journey, careful budgeting can significantly impact your financial well-being.

Start by assessing your income and expenses to create a realistic budget.

Prioritize mortgage budgeting by factoring in down payments, monthly payments, and additional costs like insurance and taxes.

This proactive financial planning empowers you to make informed decisions, ensuring you stay on track toward homeownership without unnecessary stress.

Conclusion

In conclusion, the Fintechzoom Mortgage Calculator is a powerful tool that can significantly simplify your home financing journey. For instance, if you’re considering a $300,000 mortgage with a 4% interest rate, using the calculator can quickly show you your monthly payments and help you compare different loan terms. By leveraging its features, you’re not just crunching numbers; you’re making informed choices that pave the way for financial stability and freedom in homeownership.